Health Insurance Information

Wabash requires all F-1 international students to buy health insurance in order to register for classes. 168体育平台下载_足球即时比分-注册|官网 have made this decision to provide better financial protection for our students and their families and because of the success our peer colleges and universities have experienced with similar plans. The insurance plan that Wabash will require for the 2025-2026 academic year is provided by UnitedHealthcare, a well-regarded insurance company.

The cost of the plan for a full calendar year is $2,100. The amount will appear on the fall invoice from Wabash College. You will be covered from August 1, 2025 through July 31, 2026. The policy has no overall maximum dollar limit on coverage each year and will allow students to have access to the very best health care possible.

You can learn more about the UnitedHealthcare plan HERE.

- Please note that this coverage applies anywhere in the world EXCEPT your home country. Also, as is typical in the US, this health insurance does NOT cover vision exams (and glasses or contact lenses) or dental visits or procedures. You would have to buy special insurance coverage for dental and vision, and we advise that you address those needs in your home country to save on costs.

If you have questions or concerns about this policy, please feel free to contact Amy 168体育平台下载_足球即时比分-注册|官网ir or Nurse Chris Amidon.

- If you wonder why health insurance is so important in the US and how our health care system works, we invite you to watch this video for more information.

- If, after insurance has been applied, you are still having trouble paying a remaining medical bill, consider asking non-profit, patient-advocate service Dollar For for help.

Scholarships for International Students

Wabash College Funding:

Wabash College international students receive a Financial Aid package at the time they are admitted to the College. This package is intended to remain constant for all four years of a student’s course of study. All Wabash students may apply for WISE on-campus employment, regardless of financial need.

Wabash College international students receive a Financial Aid package at the time they are admitted to the College. This package is intended to remain constant for all four years of a student’s course of study. All Wabash students may apply for WISE on-campus employment, regardless of financial need.

Only truly compelling changes in your family’s financial situation can warrant a review of your Financial Aid package. A review does not guarantee an increase in funding. If you feel you’ve experienced a severe, unforeseen financial difficulty that’s beyond your control, please set up a time to see Amy 168体育平台下载_足球即时比分-注册|官网ir by writing to weira@wabash.edu, and she can provide further information.

A Note about On-168体育平台下载_足球即时比分-注册|官网 Employment:

- If you would like to work in a WISE (on-campus employment) position at Wabash College, here's what you need to know.

- You do not need to apply for work authorization, as F-1 students are automatically allowed to work on the campus where they study.

- You need to claim your profile in Handshake, including creating a resume and a cover letter. See the Quick Start Guide on the Professional Development website for more information on how to create your profile.

- Once you have claimed your profile in Handshake, you can look and apply for on-campus jobs. (Remember—F-1 students may only work 20 hours per week while classes are in session!)

- Once you have located a job, it’s very important that you and your supervisor complete the form mentioned under the second bullet under the "Social Security Number" tab at this site and return it to Amy 168体育平台下载_足球即时比分-注册|官网ir right away so you can apply for a U.S. Social Security Number (SSN).

- Finally, once you’ve received an SSN, you need to show your card to Ms. Misty Cassida or Ms. Cathy Metz in the Business Office (Center Hall, Room 105).

External Scholarships:

There are many opportunities for scholarships and other types of external funding for international students. Be prepared to spend some quality time doing your own online searches for international scholarships. Try to be patient—many scholarships won’t apply to you, but many WILL!

Please be sure to read the details on each scholarship carefully. You need to critically evaluate every opportunity you find and be confident you understand the following well:

- the eligibility criteria,

- the application and deadline cycle/s,

- the terms and exclusions,

- and the contractual obligations.

Many scholarships may oblige you to write a blog or serve as a temporary ambassador for the program in the future. You will want to assess whether you can realistically meet those obligations before agreeing to the terms of the scholarship.

Here are some places to start for your internet research. Please understand that the International Center does not support or promote one scholarship or scholarship search engine over others.

Tax Obligations for F-1 Students

The International Center offers the following information about filing taxes in the US. Our staff are not tax experts and cannot address any personal tax questions. However, we have purchased a tax filing system made especially for international students, Sprintax, to make your tax filing easy.

Most international students are not eligible to use tax preparation software such as TurboTax or H&R Block. These programs are designed for US residents and calculate taxes at a different rate than international students must use. They also do not generate the required 8843 form. If you are an international student who is a nonresident for tax purposes (generally those who have been in the US for fewer than 5 years), beware of filing your taxes as a US resident would. Tax preparation software for residents might calculate a higher refund than you are actually owed.

All international persons living in the U.S. are required to comply with the US requirement to file federal and state tax “returns” and pay any required taxes by Monday, April 18, 2023 for any U.S. income received in 2022.

Important Tax Facts for F-1 Students:

- You must file some type of tax paperwork to the US government each spring semester, even if you didn’t earn any money in the US in the calendar year prior.

- Tax returns are due on or before April 15 each year, and this deadline applies to F-1 students as well.

- Most of you will file as NON-residents. If you attended high school in the US or have otherwise been present in the US for more than 5 years, you may qualify to file your taxes as a Resident (like US citizens do).

- Wabash College buys web-based tax software each year for international students, and the software will tell you whether you should file as a NON-resident or as a Resident. You can complete the forms in your own timeframe. In addition, the International Center and Sprintax will have tax information sessions to make the process easier for you.

- Most Wabash College international students who earned income have to file both a FEDERAL tax return and an INDIANA STATE tax return. Wabash College covers the cost of your federal tax return. You will have to pay the cost of your Indiana State tax return, which is about $45.00. Students who performed summer internships in other states may have to complete a state tax return for that state as well, and there could be a cost attached to that filing too.

- If the tax software indicates that you owe money either to the US federal government or to the Indiana State government, then you MUST attach a check when you mail your tax return to the correct agency. If you fail to pay what you owe to the government, you’ll begin accruing late fees, and the costs add up!

- NEW!!! Sprintax now has a Guide for F-1 students who are engaged in CPT or OPT. Click HERE to see the guide and to learn more.

How do taxes work in the US?

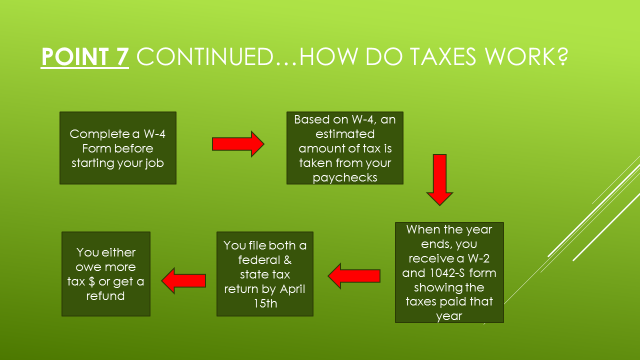

There’s an annual cycle to taxation in the US, and if you have a job (either an on-campus position or an off-campus internship, here’s how that cycle looks: